Investor Profile

Knowing your investor profile will help you work out the mix of investments that is right for you, be it Shares, Bonds, Property, Term deposits (Fixed Deposit), Mutual Funds, etc.

There are four sides to your investor profile:

- Duration: How long do you intend to invest?

- Returns: Do you want income or growth?

- Liquidity: Do you need to be able to get your money easily?

- Risk: Understanding the risk involved in different forms of investment and knowing your own attitude to risk.

Think about this before you leap into any investment decision.

There are some important rules you should follow:

1.Set Your Goals:

Decide what it is that you are trying to achieve. Where do you want to be at some point in the future? What is the final outcome you want from your investments, and what is your time frame? Think about debt - is investing the right option for you right now? Would you be better off using your money to pay off high-interest debt (e.g. hire purchase or high interest loan), or to reduce your mortgage?

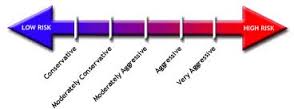

2. Know Your Risk Profile:

You need to know what type of investor you are – essentially, how much money are you willing to invest? How much volatility (ups and downs) can you tolerate? To work out your investor type, use our investment planner.

3.Know how you want to invest your money:

What mix of investments suits your investor type? Bonds, shares, property, bank deposits? Will you invest directly yourself or use managed funds? Our investment planner is here to help.

4.Do your homework:

Research, compare and contrast everything – or get someone to do that for you. Read the business sections of the newspaper, go online, talk to your adviser, bank manager, or accountant. We suggest you also read any documents, such as the investment statement or prospectus or both, relating to the investment you are considering.

5.Research different companies’ investment options:

If you are going to invest directly in a company, find out which companies suit your type. Do they offer the kind of investments you are looking for? What are the rates of return for each investment? What is the level of risk associated with the return?

6.Research the companies themselves:

What does the company do? What markets is the company in? Who is running the company? Have they ever been declared bankrupt? How is the company run? Does the board have independent directors? How has the company performed in recent years – is there a steady performance over time?

7.Spread your risk:

As the saying goes, don’t put all your eggs in one basket. Spread your risk around different options and different companies. For example, if you are considering high-risk investments, you can balance your risk with other investments in lower risk areas, like bank deposits or cash and bonds.

8. Finally, always get the right advice! And that is why we are here. Talk to GIS now for the safe and reliable advice you need to help you make the right investment decision.

Contact Us:

[email protected] , [email protected] 026 55 60 612

Process of filling the form

Download form

Fill the form

Upload form here

Ghanaian Cedi Exchange Rate

Ghanaian Cedi Exchange Rate